The IMF’s approach to buttressing macrostability in the Global South is highly problematic. Dismissive of the effects that exogenous variables have on local economic performance, the institution has regularly engendered results opposite to those notionally aspired for: By enforcing measures like subsidy cuts, value-added taxes (VAT), and currency devaluation, the IMF’s interventions often fuel inflation—and deepen macroeconomic troubles.

This article considers how IMF interventions have played out in West Asia and North Africa (WANA). Using Egypt and Tunisia as case studies, it demonstrates why Fund-mandated reforms actually worsened issues they were meant to fix. Conversely, the article shows that why policy playbooks developed by the IMF and the states of the WANA region in the mid-late 20th century retain considerable merit.

The IMF across time

The IMF was established in 1944 to provide financial assistance to countries facing macroeconomic imbalances. Its underlying objective was to boost international trade. In the early years, the Fund served its mission by promoting capital controls and price stability and guaranteeing currency convertibility at a fixed exchange rate (i.e. the unrestricted exchange of money into gold or USD at a set rate).[1] For countries facing external payments deficits, the implications of this policy triad meant external imbalances were addressed through monetary adjustment: In reducing domestic credit creation through raising interest rates, inflationary dynamics could be controlled and exports made more competitive. Taken together, these two shifts would serve to stabilize prices and correct trade deficits without any need for currency devaluation.[2] Early IMF policy designers considered currency devaluation and turbulent flows of hot money dangerous, deeming them responsible for the extreme destabilization of the global economy in the 1920s and 1930s.[3] Through its interventions, the Fund hoped to provide members ‘‘with opportunity to correct maladjustments in their balance of payments without resorting to measures destructive of national or international prosperity.”[4]

In the 1950s, a number of countries from the Global North turned to the IMF for assistance in mitigating external imbalances. For instance, following the Suez Crisis of 1956, Britain and France both came to the IMF’s door. The two were granted what was at the time the Fund’s largest ever loan—roughly $1.5 billion, or $17.5 billion in today’s dollars.[5] Through this capital injection, the borrowers were able to avoid devaluing their currencies while combating inflation at home, thereby preserving the fixed exchange rate system.[6] Neither borrower was subjected to a wider regime of loan conditionality in receiving the IMF’s support.

Come the 1980s, however, the Fund would, for all effects and purposes, renounce the principles by which it had previously buttressed macroeconomic stability. The institution’s pivot was concurrent with global capitalism’s drift into crisis and the attendant emergence of Global South countries as the IMF’s primary clientele. On the question of exchange rate policy, the Fund pushed Southern countries toward currency devaluation and floating exchange rates—policies that were elevated to a “principle” of the new Washington Consensus.[7] It did so through Structural Adjustment Policies (SAPs), which leveraged loan conditionality to impose policy change. Beyond reform of exchange rate policy, the IMF of the post-1980s also adopted austerity, capital account liberalization, and deregulation as the pillars of its refashioned interventionism.

In 1983, UN economist Sydney Dale predicted that the IMF’s change in outlook would bring suffering upon developing countries. The reason was that the Fund’s novel policy tools would do nothing to attenuate the drivers of global imbalances.[8] Those drivers were predominantly exogenous to the Global South, deriving from international supply shocks (e.g. oil crises in the 1970s, or, in more recent times, the Ukraine war) or the tightening of monetary conditions in the United States. As the factors threatening macrostability in the South did not originate at home, Dale recognized that imposing structural reform upon countries of the periphery would be unlikely to restore their economies (and societies) to good health: It was akin to treating a patient with the wrong medicine—while ignoring the external contaminants making them sick.

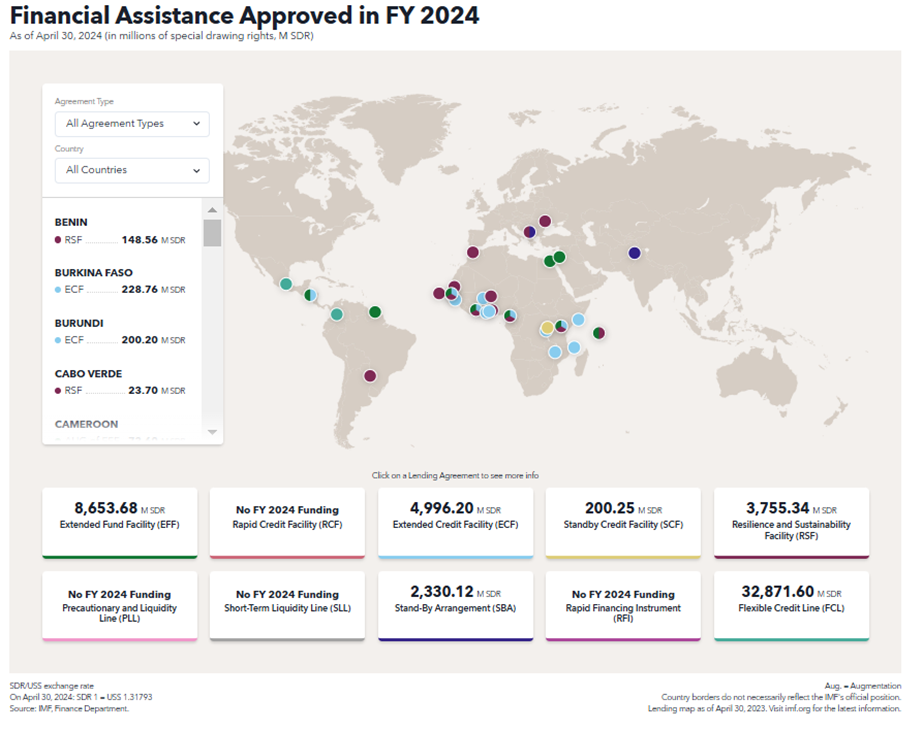

The exogenous variables touched on above have left much of the Global South facing recurring balance of payment issues over the last four decades. IMF interventions, meanwhile, have rarely helped “beneficiaries” steady the ship. These realities are most plainly revealed in the geography of the IMF’s lending. Taking 2024 as an example, virtually all the Fund’s loans went to low- and middle-income countries in the Global South (see figure below).[9] A longitudinal approach also shows that Fund borrowers frequently become serial debtors, forced to return for more assistance after previous IMF bailouts intensify underlying problems.

The IMF and the WANA region post-2011

The IMF’s 1980s-era pivot has been of grave consequence for the countries of the WANA region. Structural adjustment programs imposed during the 1980s and 1990s often yielded disastrous results, be it socially, developmentally, or when it came to macrostability. Fund interventions in the years after the Arab Spring have also failed to deliver, both on their own terms and more generally speaking.

The Fund’s post-2011 failures are clearly evinced in the case of its ventures into inflation control and macrostability promotion in Egypt and Tunisia. In both countries, the IMF’s interventions leaned on the following policy mix:

- Currency devaluation and exchange rate liberalization to fix external imbalances

- Interest rate hikes to counter the inflation which results from devaluation

- The removal of energy subsidies and increasing of VAT rates to restore fiscal balance.

Devaluation and external imbalance

On the front of exchange rate policy, the IMF’s recommendations derived from theories developed in neoclassical schools of economics. As those schools hold, overvalued currencies make exports overpriced and hence less competitive. With devaluation, exports become more competitive and imports more expensive. The joint effect is to bring the trade ledger back into balance.

While looking like a tidy solution on paper, for Egypt and Tunisia, the real world effect of the IMF’s exchange rate policies proved anything but. As the table below shows, the currency devaluations that took place in Egypt and Tunisia in 2016 were actually followed by deteriorations in the countries’ trade balances. There were two main reasons for this, each having to do with the price elasticity of demand. The first is that the price elasticity of demand for the exports of Egypt and Tunisia is relatively low: To wit, drops in the price of their exports do not prompt customers to purchase significantly more Egyptian or Tunisian goods. This being the case, gains in the volume of exports yielded by currency devaluations post-2016 would not be sufficient to offset losses incurred as a result of the declines in price.[10] The second reason is that Egypt and Tunisia’s demand for imports is relatively price inelastic: Both being energy and food dependent, these countries have little space for cutting imports, regardless of their national currency’s purchasing power. This being the case, devaluation did little to reduce the import bill. It also fed inflation by increasing the local price of basic goods. In pushing up the price of inputs and wages, moreover, the inflationary dynamic also ended up reducing the competitiveness of exports, further worsening the trade balance.

| Table 1: External balance on goods and services (% of GDP) | |||

| 3-year average before the 2016 devaluation | 3-year average after the 2016 devaluation | Outcome | |

| Tunisia | -0.99 | -11.8 | deterioration |

| Egypt | -0.77 | -10.2 | deterioration |

| Source: “World Bank Data. “External balance on goods and services (% of GDP). World Bank Data, 2024. https://data.worldbank.org/indicator/NE.RSB.GNFS.ZS | |||

The Ecological Cost of Devaluation Though not immediately related to external imbalances, one should also note that the IMF’s devaluation strategy also places more pressure on the two countries’ ecological capital. This is because the export baskets of both are predominantly comprised of primary commodities and factor-driven (i.e. resource intensive) manufactures such as textiles and fertilizers: Reducing the unit value of exports through devaluation forces greater extraction and/or processing of natural resources as Tunisia and Egypt attempted to export greater quantities of the goods in question.

Interest rate hikes and inflation

The reforms of 2016 prompted an inflationary spiral in both of our case study countries. In each instance, inflation was initially driven by the devaluation itself, which made imports, upon which Egypt and Tunisia are highly dependent, more costly in local currency. Thereafter, inflation was intensified by a series of exogenous shocks. The latter include jumps in the price of commodities on international markets—caused to no small degree by speculators in northern derivative markets—and supply chain disruptions.

In circumstance of cost-push inflation such as these, the monetary tightening that the IMF pushed (i.e. increasing interest rates) was always to be of limited efficacy. The veracity of this claim is most tragically apparent in what has transpired in Egypt. Squeezing the money supply there had some impact on prices as a whole. When it came to the goods most critical to households’ reproduction, however, interest rate hikes did nothing to arrest inflation. This is because regardless of price, demand for essentials remained high as households could not meaningfully cut back expenditures on the likes of grains, cooking oil, medicine, or education. The result: prices of essential commodities over the past eight years have risen at a much higher rate than their non-essential counterparts. In fact, the country has had had one of the largest gaps in the world between the inflation of essential and non-essential goods.[11]

The distributive effects of Egypt’s uneven inflation have been pronounced. With low-income households spending a greater portion of their income on essentials, their purchasing power has been disproportionately hurt by the IMF-mediated inflationary wave of the last eight years. Note as well that during the same period, Egypt’s wealthiest persons were actually accruing greater income via IMF-mandated interest rate hikes. They did so through their savings and CD accounts and treasury investments, the yields on which all increased significantly by way of the increase in interest rates.[12] Beyond failing to control inflation, then, one of the major consequence of the IMF’s program was to worsen inequality considerably. Another was to contribute to the weakening of Egypt’s productive capacity: With borrowing costs pushed upward due to the high interest rate regime, many businesses withheld investment or were forced to shut up shop.

The IMF and Fiscal Balance

Subsidy cuts

The IMF’s program for restoring fiscal balance has also failed to pass muster. Beginning with price subsidies, the IMF made two cases in advancing reform in Egypt and Tunisia: (i) Subsidies distort prices, thereby hindering market efficiency; and (ii) Subsidies are costly, depriving the government of funding needed for investment, while also disproportionately benefiting wealthy households.

The first argument concerning market efficiency is weak, particularly in comparative context. After all, the IMF’s devaluation policy has wholly shortcircuited price signals in addition to creating high levels of business uncertainty in Egypt and Tunisia. Relative to these effects, those of subsidies are marginal. Taking into account the IMF’s own record, then, it is hard to be persuaded that subsidies ought be disqualified due to their impacts on market efficiency.

The IMF most clearly laid out the second of its arguments in a 2015 study titled ‘The Unequal Benefits of Fuel Subsidies Revisited’. There, Fund economists point out that “the richest 20 percent of households capture…more than six times more in fuel subsidies than the poorest 20 percent, making universal fuel subsidies a very inefficient policy instrument for protecting poor households from fuel price increases”.[13] (Note that though the IMF’s calculations are accurate, there are different metrics for evaluating the progressiveness or regressiveness of subsidies: If consumption of subsidized energy is measured as a percentage of income, for instance, low-income households in Egypt and Tunisia would rank as their primary beneficiaries as they spend a larger portion of their income on energy[14]). On the basis of the two claims, the Fund consistently posited that targeted cash transfers presented a preferable alternative to subsidies—one that is at once more fiscally efficient and socially equitable.

What do the empirics show us?

Plainly, the record of subsidy reform when it comes to social justice and social protection is woeful. In Egypt, the elimination of energy subsidies precipitated massive increase in living costs for lower-income Egyptians. It primarily did so by aggravating inflation for essential commodities—not only energy itself, but those goods for which energy is a significant input in the production process. The transition to cash transfers, meanwhile, proved terribly inadequate for insulating lower-income households from rising costs. This is attributable to harsh eligibility restrictions on cash transfers, which function to exclude a large share of the vulnerable from receiving state aid.

Targeted Cash Transfers: A Means for Excluding the Egyptian Poor from Benefits As the World Bank has acknowledged, extremely high degrees of exclusion errors in Egypt’s cash transfer programs have left many low-income people without any state support following the lifting of subsidies. Empirically, more than half of Egyptian households in the poorest quintile have been excluded from cash transfers due to administrative issues and rigid eligibility criteria.[15][16][17] Largely as a result, poverty rates have increased from 27.8% in 2015 to well above 35% today.[18] This outcome defies the IMF’s age-old claim that targeted assistance is a more efficient and just mechanism for addressing poverty. Nor is the lack of coverage reach the only demerit of the targeted transfer program: There is also the inadequacy of support it provides to beneficiaries. This is evinced in the fact that cumulative inflation for extremely poor households increased by 81% in the three years following the 2016 IMF program, while the average transfer provided to beneficiaries of the cash transfer program rose by only 15.2%.[19] In circumstances where more than half the population would be eligible for some form of assistance, the wisdom of leaning on targeted policies is exceedingly dubious. In offering a universal safety net, contrarily, price subsidies help ensure broad access to essential goods without the complex bureaucracy and high exclusion errors that often accompany cash transfer programs.

Seen in full, the effects of energy subsidy reform in Egypt—which amounted to roughly 5% GDP—are antithetical to the cause of social justice. This is not only because reform led to large shares of the poor being deprived of state aid. It is also because reform helped enrich the wealthy: Contrary to public messaging, the fiscal savings incurred via subsidy cuts were not used to control the state’s deficit or fund targeted assistance programs, but to fund higher interest payments on sovereign debt. The latter effect, though indirect, can be seen in the budget resources devoted to debt repayments after the introduction of subsidy reform: expenditures on this line item increased from below 8% of GDP in 2013[20] to over 13% in 2023/2024.[21]

In Tunisia, a similar story is unfolding. On the basis of the same arguments put forth in Egypt, the IMF targeted reform of both energy and food subsidy systems and their replacement with targeted cash transfers.[22] Historically, those subsidy systems were deployed to control inflation, support the purchasing power of Tunisians, control wages to ensure Tunisia’s competitiveness in the international market, and improve nutrition.[23]

Like in Egypt, the degradation of the subsidy regime has, in combination with the shortcomings of targeted cash transfers, redounded to the detriment of the most vulnerable. With subsidies lifted and transfers missing more than half of the eligible population, ever-growing shares of the poor are today left fending for themselves against rapidly increasing prices.[24] This outcome lends further credence to the idea that subsidies offer a more optimal way of protecting the poor. Per a 2017 study by the Centre de Recherches et d’Etudes Sociales (CRES), the social protection program with the most positive impact on poverty reduction in Tunisia is universal food subsidies, followed by energy subsidies. The program with the least impact on poverty: targeted cash assistance (PNAFN).

| Table 2 Comparing the effectiveness of different subsidy systems in Tunisia | |||

| PNAFN (cash assistance) | Food subsidies | Energy subsidies | |

| Accuracy of targeting (%) | 46.9 | 100 | 100 |

| Effect on the incidence of poverty (%)* | 21.73 | 39.21 | 27.96 |

| Effect on the poverty gap (%) | 21.73 | 39.21 | 27.96 |

| Effect on the severity of poverty (%) | 36.2 | 29.46 | 21.45 |

| Source: Centre de Recherches et d’Etudes Sociales. “Évaluation de La Performance Des Programmes d’assistance Sociale En Tunisie.” CRES.tn, January 1, 2017. http://www.cres.tn/uploads/tx_wdbiblio/Rapport_CRES_mai_2017.pdf. * Effect measures how much has the social transfer programme reduced the poverty rate, the poverty gap or the severity of poverty | |||

The Progressiveness of Tunisia’s Food Subsidies The same CRES study also concluded that Tunisia’s food subsidy system represents the most progressive social protection option for the country: In making up 7.7% of household consumption at the lowest income quintile but only 1.5% of consumption at the top, in relative terms, the benefits of the program increase as one moves down the income ladder.[25] Taking food subsidies’ wider contributions into account—nutritional improvement, inflation control, social stability, keeping the lower middle class from falling into poverty—its superiority as a policy option is apparent.

The value-added tax premium

Factoring in second-order effects and opportunity costs, the IMF’s prioritization of value-added taxes (VATs) appears equally misguided to its subsidy reform agenda: more optimal alternatives clearly existed for raising public revenues. In Egypt and Tunisia as elsewhere, the Fund stumped for the VAT on the basis of the measure’s administrative simplicity, on the one hand, and the fact that the tax is not distortionary of markets on the other. The VAT’s overtly regressive nature, meanwhile, did not garner mention, drawing a stark contrast with the Fund’s pro-subsidy reform arguments. Similarly neglected was the VAT’s inflationary effects, which are baked in as it is a tax on consumption.

The VAT has helped increase the two governments’ annual revenues, as a simple review of financial disclosures reveal. Nevertheless, it was hardly the only (or most ideal) way for doing so. In view of the Fund’s professed objectives around macrostability, the imposition of property taxes would have been preferable. In terms of simplicity, property-related taxes are even easier to administer and enforce, especially when targeting high-value properties which are more likely to be properly registered. Property taxes also provide a potential secondary benefit when it comes to macrostability by way of inflation control: In incentivizing property owners to seek cash flow for covering tax obligations, the supply of available rentals may increase due to more unoccupied non-primary residences being brought onto the market, helping bring down prices in the process.[26] Furthermore, in view of the speculative nature of real-estate markets in the region, property taxes could help limit bubbles and steer investment flows toward productive activities.

Missed Opportunity: The IMF and Property Taxes Despite the IMF placing a premium on the need for WANA governments to increase tax revenues, it has largely neglected the potential of property taxes. This is the case even though the region has one of the lowest rates of property taxation in the world: Relative to GDP, WANA property tax revenues are only a sixth of the OECD average.[27] In Lebanon, excluding property registration fees, property taxes only contribute 0.34% to annual tax revenues. A tax on vacant luxury properties–constituting 23% of all vacant property–could raise around $100 million annually. This would be enough to subsidize rents for 50,000 households, build twenty-five housing cooperatives per year (each comprised of 350 households), and to cover the construction bill for a build-up of 1,000 new homes per annum (on state-owned land). For reasons earlier discussed, property taxes could also push owners of vacant properties to rent them out and thereby reduce rental prices. With average rents exceed average wages in the country, such price reductions are desperately needed.[28] In Egypt, property tax revenues has constituted no more than 0.41% of total tax revenues in recent years. To put this in perspective, the corresponding percentage in the US, UK, and France is 16%, 12.5 and 9% respectively.[29] In Jordan, a property tax imposed only on vacant properties could generate enough revenue to cover half of the social security contributions of 300,000 informal workers, not to mention the counter-inflationary impact of increasing the housing supply.[30]

Conclusion

A one-time senior official at the IMF recently presented the WANA region’s debt crises as follows:

The…tryst with debt crises is not a recent phenomenon. The region witnessed episodes of debt distress during the 1980s and 1990s […] Poor management of fiscal and external imbalances led to multiple instances of restructuring of debt that was primarily public and publicly guaranteed…The highly indebted MENA nations find themselves in the path of a debt storm spawned by internal inefficiencies, poor governance, and an unforgiving global economy. Dodging this tempest will require swift, pinpointed interventions; real reform; and the readiness and ability to face up to debt restructuring.[31]

As this article clarifies, the IMF’s attribution of crises in the WANA region to local policy failures is at best self-serving. At worst, it reflects a form of paternalism that mystifies how global forces impact economic outcomes in the South—and how the IMF itself has contributed to the reproduction of crises.

By reversing the IMF’s gaze of technocratic efficiency, this article reveals how the Fund’s imposition of currency devaluation, subsidy reform and VAT in the WANA region have proven distinctly inflationary while intensifying inequality and worsening external imbalances. Notwithstanding their flaws, it has also shown why “traditional” national policies like price subsidies and currency management—by cushioning low-income populations against inflationary pressures and volatile global prices—represent more effective stabilizers. The relative efficiency of those policies stems from their being tailored to local economic contexts. While the IMF dismissed such measures as inefficient or distortionary, subsidies in particular are more effective in preventing sharp price increases on essential goods. They also help stabilize everyday costs, steady macroeconomic performance, and reduce the inflationary burden falling on vulnerable households. For those looking to build a better future for the region, perhaps it would be wise to look to the past for some design ideas.

[1] Boughton, James M. “The IMF and the Force of History: Ten Events and Ten Ideas That Have Shaped the Institution.” imf.org, May 1, 2004.

Article IX of the IMF Articles of Agreement specifies a commitment to price stability. It reads: ‘Each member shall endeavour to direct its economic and financial policies toward the objective of fostering orderly economic growth with reasonable price stability’. This, according to the same article, can only be achieved by ‘assuring orderly exchange arrangements’ and promoting ‘a stable system of exchange rates’.

[2] James M. Boughton, “The IMF and the Force of History: Ten Events and Ten Ideas That Have Shaped the Institution.” imf.org, May 1, 2004. https://www.imf.org/en/Publications/WP/Issues/2016/12/30/The-IMF-and-the-force-of-History-Ten-Events-and-Ten-Ideas-that-Have-Shaped-the-Institution-17199.

[3] Teru Nishikawa, “Shaping the Fund’s Policy for Exchange Liberalization.” Essay. In History of the IMF Organization, (Tokyo: Springer, 2015), 47–66.

[4] IMF. “Articles of Agreement.” imf.org, 2024. https://www.imf.org/external/pubs/ft/aa/index.htm.

[5] International Monetary Fund. “Money Matters, an IMF Exhibit — the Importance of Global Cooperation, Destruction and Reconstruction (1945-1958), Part 5 of 6.” IMF.org. Accessed November 12, 2024. https://www.imf.org/external/np/exr/center/mm/eng/mm_dr_04.htm.

[6] Boughton, James M. “Was Suez in 1956 the First Financial Crisis of the Twenty-First Century?” Finance and Development | F&D, September 2001. https://www.imf.org/external/pubs/ft/fandd/2001/09/boughton.htm.

[7] Cohen-Setton, Jérémie. “The New Washington Consensus.” Bruegel, August 29, 2016. https://www.bruegel.org/blog-post/new-washington-consensus.

[8] Dell, Sidney. “On Being Grandmotherly: The Evolution of IMF Conditionality.” CEPAL Review 1982, no. 16 (April 16, 1982): 177–91. https://doi.org/10.18356/5a3fc447-en.

[9] International Monetary Fund. “IMF Annual Report 2024: Lending.” International Monetary Fund, 2024. https://www.imf.org/external/pubs/ft/ar/2024/what-we-do/lending/.

[10] Section 3.2 of the referenced paper shows that Global South exports are usually underpriced, and devaluation only serves to exacerbate this undervaluation. Diab, Osama. “Out of Inflation Control: The IMF and Rampant Inflation in MENA.” American University in Cairo, 2024. https://aucegypt.us21.list-manage.com/track/click?u=d445c850037d5557d98f417f3&id=4e086f66c8&e=196320e8c0.

[11] This is measured by the real food inflation index, which measures the difference between the inflation of food products and the general inflation. Published every quarter in the World Bank’s Food Security Update, Egypt has been making frequent appearances in the index’s top ten countries for years The updates can be accessed from the following link: https://www.worldbank.org/en/topic/agriculture/brief/food-security-update/data-and-research

[12] Diab, Osama. “The IMF and Ending Energy Subsidies in Egypt.” TNI.org, September 20, 2023. https://www.tni.org/en/article/the-imf-and-ending-energy-subsidies-in-egypt.

[13] Coady, David, Valentina Flamini, and Louis Sears. “The Unequal Benefits of Fuel Subsidies Revisited: Evidence for Developing Countries.” IMF.org, November 25, 2015. https://www.imf.org/en/Publications/WP/Issues/2016/12/31/The-Unequal-Benefits-of-Fuel-Subsidies-Revisited-Evidence-for-Developing-Countries-43422.

[14] Diab, Osama. “The IMF and Ending Energy Subsidies in Egypt.” TNI.org, September 20, 2023. https://www.tni.org/en/article/the-imf-and-ending-energy-subsidies-in-egypt.

[15] Breisinger, Clemens; Gilligan, Daniel; Karachiwalla, Naureen; Kurdi, Sikandra; El-Enbaby, Hoda; Jilani, Amir Hamza; and Thai, Giang. 2018. Impact evaluation study for Egypt’s Takaful and Karama cash transfer program: Part 1: Quantitative report. MENA RP Working Paper 14. Washington, DC and Cairo, Egypt: International Food Policy Research Institute (IFPRI). http://ebrary.ifpri.org/cdm/ref/collection/p15738coll2/id/132719

[16] Kidd, Stephen, Bjorn Gelders, and Diloá. Bailey-Athias. 2017. “Exclusion by Design: An Assessment of the Effectiveness of the Proxy Means Test Poverty Targeting Mechanism.” In . Geneva: ILO.https://researchrepository.ilo.org/esploro/outputs/encyclopediaEntry/Exclusion-by-design/995328431502676#file-0.

means test poverty targeting mechanism. International Labour Office Development Pathways.; world bank

[17] World Bank Group. “Egypt Public Expenditure Review for Human Development Sectors.” WorldBank.og, October 17, 2022. https://www.worldbank.org/en/country/egypt/publication/egypt-public-expenditure-review-for-human-development-sectors.

[18] The government has been refraining from publishing poverty figures since 2020. However, estimates by Heba al-Laithy of Central Agency for Public Mobilization and Statistics (CAPMAS) estimated the figures to have risen to 35.7% in July 2023. Due to successive waves of inflation and devaluation since, this figure is expected to have increased even further. See here for more details: https://aps.aucegypt.edu/en/events/110/open-panel-discussion-at-aps-on-poverty-figures-in-egypt-an-inflation-driven-increase

[19] Diab, Osama. “Egypt, the IMF and Three Subsidy Approaches.” library.fes.de, June 2023. https://library.fes.de/pdf-files/bueros/tunesien/20432.pdf.

[20] Ibid.

[21] You can see the details of the fiscal spending plan in Table 3B on page 30 of the latest IMF report on Egypt available at this link:https://www.imf.org/en/Publications/CR/Issues/2024/04/26/Arab-Republic-of-Egypt-First-and-Second-Reviews-Under-the-Extended-Arrangement-Under-the-548335

[22] Menzli, Ayoub. “Tunisia’s IMF Deal: The Country’s Subsidies under Threat.” timep.org, February 23, 2023. https://timep.org/2022/12/21/tunisias-imf-deal-the-countrys-subsidies-under-threat/.

[23] Chandoul, Jihen, and Chafik Ben Rouine. “Uncovered: The Role of the IMF in Shrinking the Social Protection.” library.fes.de, September 2022. https://library.fes.de/pdf-files/bueros/tunesien/19559.pdf.

[24] Centre de Recherches et d’Etudes Sociales. “Évaluation de La Performance Des Programmes d’assistance Sociale En Tunisie.” CRES.tn, January 1, 2017. http://www.cres.tn/uploads/tx_wdbiblio/Rapport_CRES_mai_2017.pdf.

[25] Centre de Recherches et d’Etudes Sociales. “Évaluation de La Performance Des Programmes d’assistance Sociale En Tunisie.” CRES.tn, January 1, 2017. http://www.cres.tn/uploads/tx_wdbiblio/Rapport_CRES_mai_2017.pdf.

[26] Segú, Mariona. “The Impact of Taxing Vacancy on Housing Markets: Evidence from France.” Journal of Public Economics 185 (May 2020). https://doi.org/10.1016/j.jpubeco.2019.104079.

[27] Diab, Osama. “Property Taxes: Missed Opportunities for Funding Universal Social Protection in Lebanon, Morocco, and Jordan?” arab-reform.net, October 30, 2024. https://www.arab-reform.net/publication/property-taxes-missed-opportunities-for-funding-universal-social-protection-in-lebanon-morocco-and-jordan/.

[28] Abou Rouphaël, Christina. “How can land and property taxes secure affordable housing” in “Property Taxes: Missed Opportunities for Funding Universal Social Protection in Lebanon, Morocco, and Jordan?” arab-reform.net, October 30, 2024. https://www.arab-reform.net/publication/property-taxes-missed-opportunities-for-funding-universal-social-protection-in-lebanon-morocco-and-jordan/.

[29] Alternative Policy Solutions. “Property Taxes: Tax Justice Lost in the Maze of Property Cataloguing.” American University in Cairo, October 23, 2023. https://aps.aucegypt.edu/en/articles/1324/property-taxes-tax-justice-lost-in-the-maze-of-property-cataloguing.

[30] Awad, Ahmed. “Toward enhancing social protection for unorganized workers in Jordan” in “Property Taxes: Missed Opportunities for Funding Universal Social Protection in Lebanon, Morocco, and Jordan?” arab-reform.net, October 30, 2024.

[31] Mazarei, Adnan. “Debt Clouds over the Middle East.” IMF.org, September 1, 2023. https://www.imf.org/en/Publications/fandd/issues/2023/09/debt-clouds-over-the-middle-east-adnan-mazarei.

This publication has been supported by the Rosa-Luxemburg-Stiftung. The positions expressed herein do not necessarily reflect the views of Rosa-Luxemburg-Stiftung.

Photo Credit: International Monetary Fund